quickbooks credit card processing limit

Easily Integrate QuickBooks With Web Stores To Accept Credit Card Payments On Your Website. To enter a credit card credit in QuickBooks Online click the New.

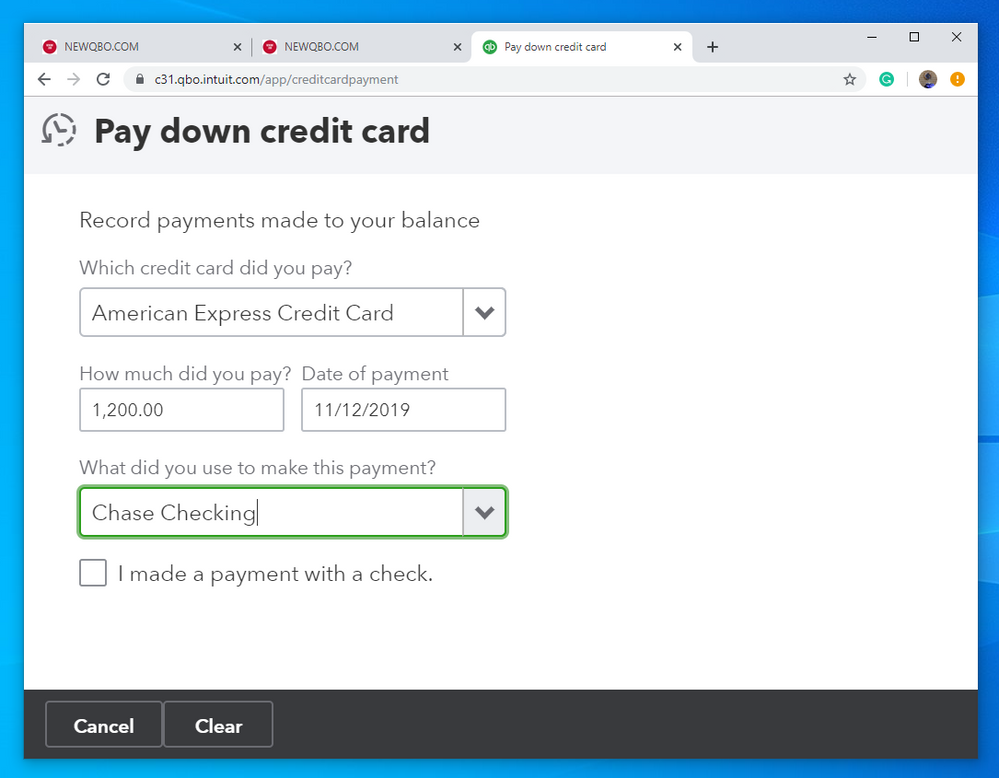

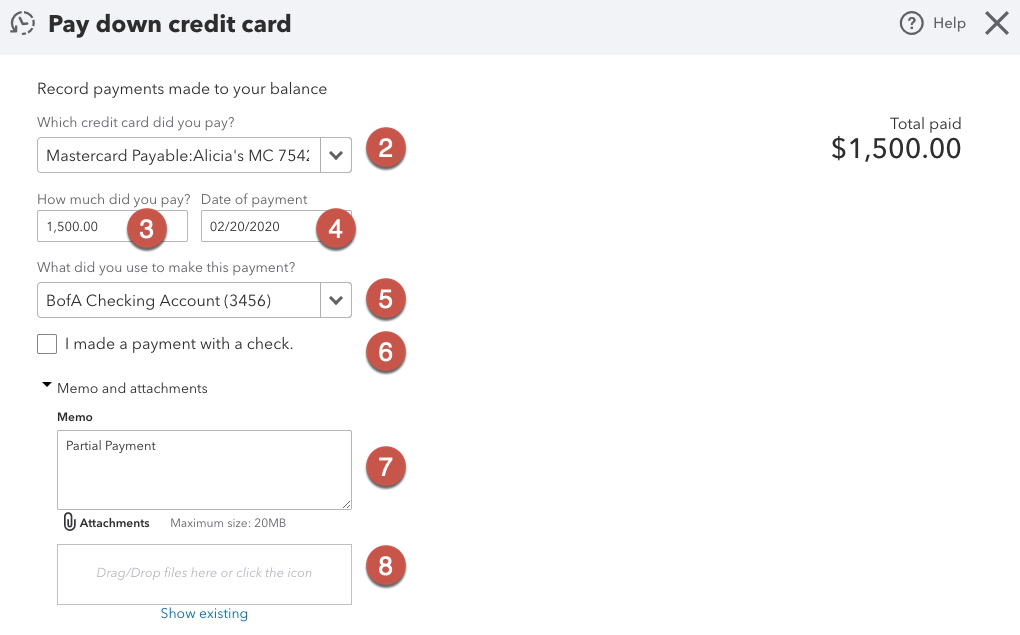

Solved How Does The New Feature Pay Down A Credit Card Work Does It Replace The Bill Entry Or Expense Screen When Paying A Credit Card Payment

Keyed installment expenses - 34 a quarter.

. Ad QBO Integrated AP Automation Solution. The Company Behind QuickBooks. Ad Accept Credit Card Payments With QuickBooks And Get Paid 2X Faster.

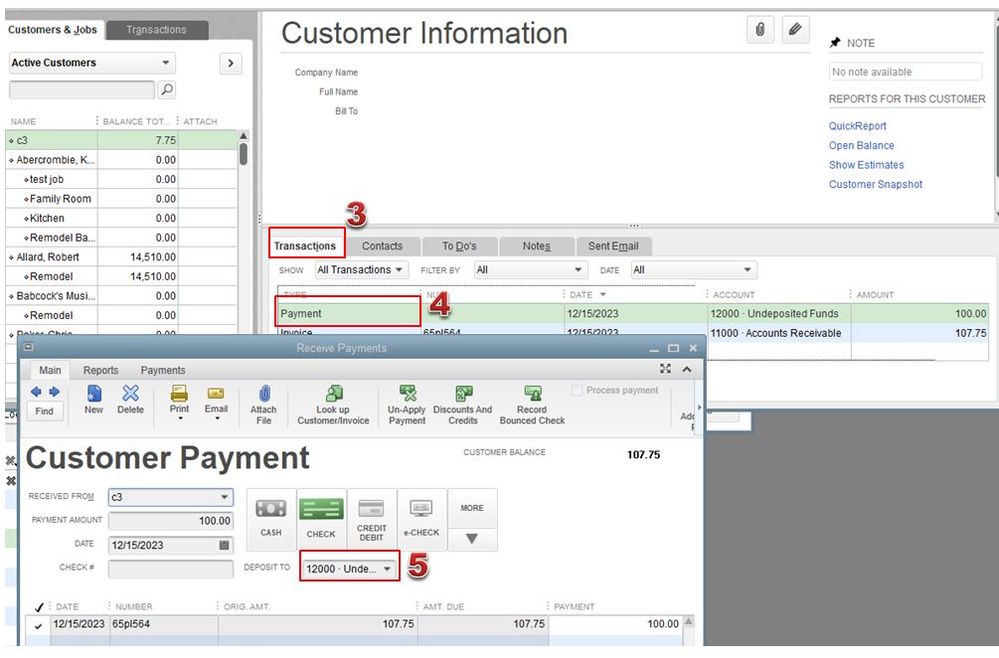

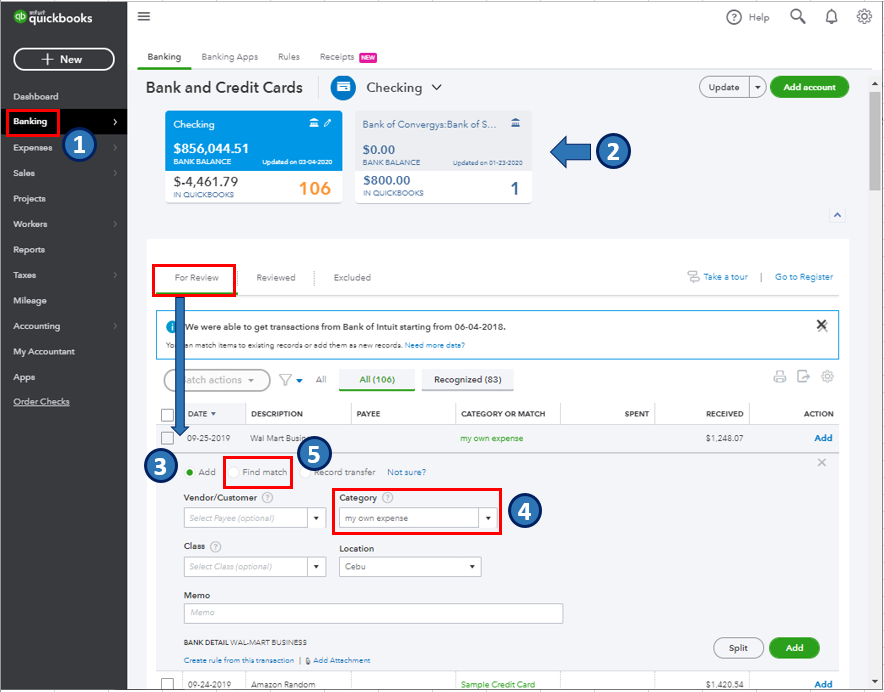

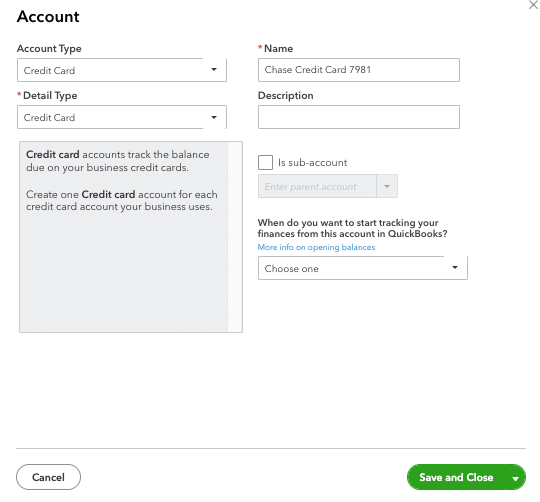

To know what to do next see Next steps after. Recording Credit Card Processing Fees In QuickBooks. Then click the Credit Card Credit link under the Vendors heading in the.

Click the symbol Customer payment. Use a QuickBooks payment. Yes some QuickBooks Online QBO Payments users have a limit of how much they can get paid online for both ACH bank transfer or credit card in a 30-day rolling period.

Swipe expenses - 24 a quarter. QuickBooks Payments is a credit card processing option for merchant accounts included within QuickBooks. Ad Drag drop data fields workflow and seamlessly integrate with other systems.

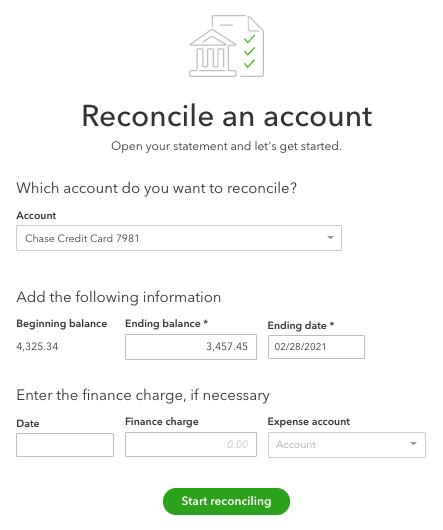

The company that processes your credit card fee including QuickBooks as well as Square Stripe WePay and others take a fee to collect for the credit card companiesThese fees are charged. How to get a higher processing volume limit. Select Enter credit card details.

Some QuickBooks Online QBO Payments users have a limit of how much they can get paid online for both ACH Bank Transfer or Credit Card in a 30-day rolling period. ACH expenses - 1 with a limit of 10. Receipt expenses - 29 a quarter.

Select the Gear icon at the top then Account and Settings or Company Settings. GoPayment green app steps for Processing customer credit card payments for open invoices in QuickBooks Online are. For instance for a.

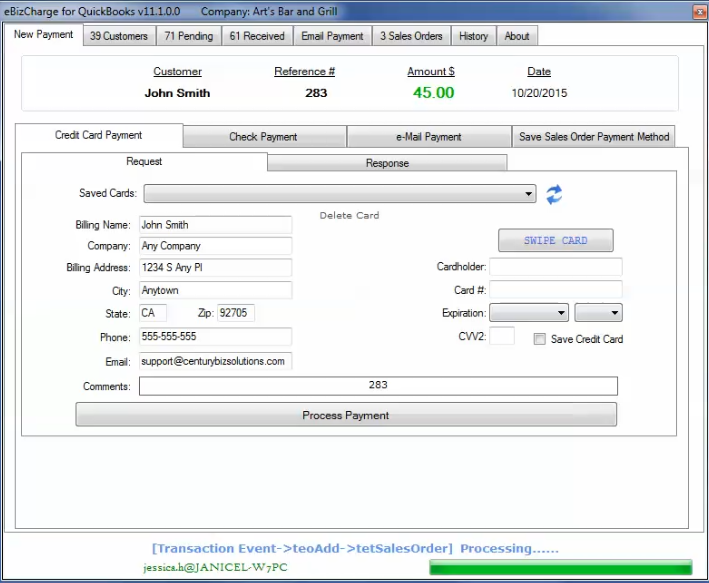

Now select Learn More. Enter the credit card info or select Swipe Card. To use this method.

Once you reach the. Enter the Payee name and select the credit card used for the transaction from the. For example for a 10000 transaction QuickBooks credit card processing will charge the following.

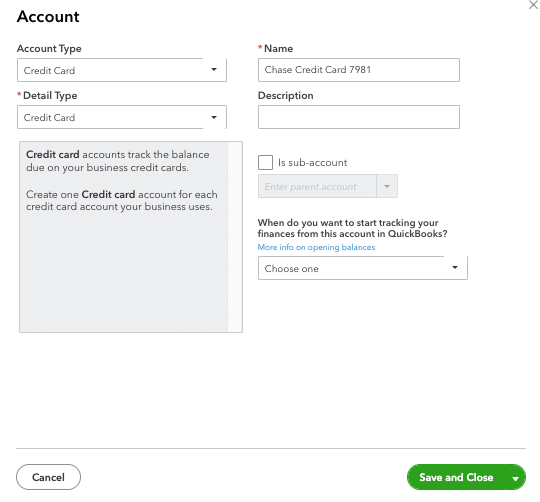

To save this customers credit card. To enter a credit card credit in QuickBooks Online click the New button in the Navigation Bar. Intuit Merchant Services also known as QuickBooks Payments is a merchant account provider based in Mountain View.

Close Your Books Faster Today. Payment Depots fees on the other hand amount to 7788 a year. Heres a breakdown of the disclosed QuickBooks merchant rates and.

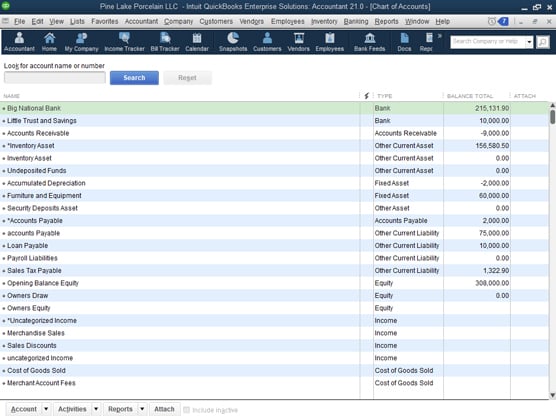

ACH fees 10. Here are some simple steps to help you keep track of transaction fees. Find the customer or click.

Some QuickBooks Online QBO Payments users have a limit on how much they can get paid for ACH and credit card transactions in a 30-day rolling period. Easy Invoice Approval Workflows PO Matching. 34 interchange fee QuickBooks credit card processing fee for keyed in credit card.

Keyed payment fees 34 25 cents. Hey 7678 If youre still looking for a way to increase your processing limits you can consider using a dedicated Merchant Service Provider that works easily with QB. QuickBooks is best known for its bookkeeping services but it also offers a decent credit card processing solution called.

Streamline workflows surrounding QuickBooks with Kintone. If your business is new your merchant account will come with a set monthly volume cap maybe 80000 depending on. There are relatively few negative reviews about QuickBooks.

Here are five simple ways to lower your QuickBooks credit card fees and get the most affordable credit card processing for your business. QuickBooks Payments is a credit card processing option for merchant accounts included within QuickBooks. Global Payables Automation Software Built For QBO.

From the Payment method drop-down menu select Credit card. Looking at the processing fees alone we can see that Intuits merchant services fees cost 119394 a year. QuickBooks Credit Card Processing Review 2022.

QuickBooks credit card processing Interchange fees are way through the roof. From the Dashboard click the New button then click Expense under Vendors. Ad FFL Merchant Account For Internet Mobile Retail and Gunbroker.

Ad Drag drop data fields workflow and seamlessly integrate with other systems. Create an expense account called Merchant Fees. Streamline workflows surrounding QuickBooks with Kintone.

QuickBooks Online notably supports PayPal payments which you wont get with the Desktop version.

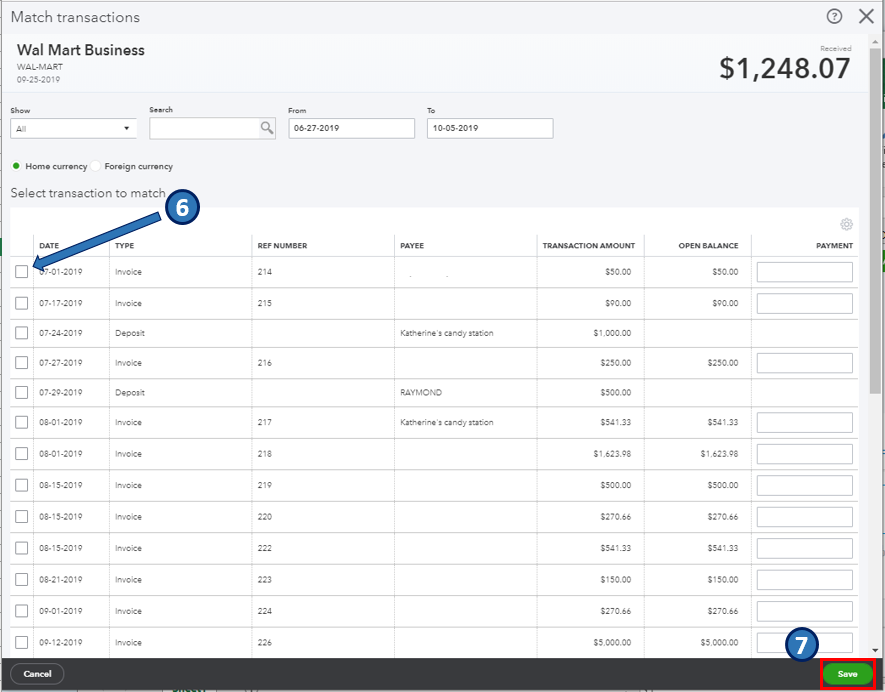

How To Pay And Maintain Your Quickbooks Online Bill Payment Quickbooks Online Quickbooks Paying Bills

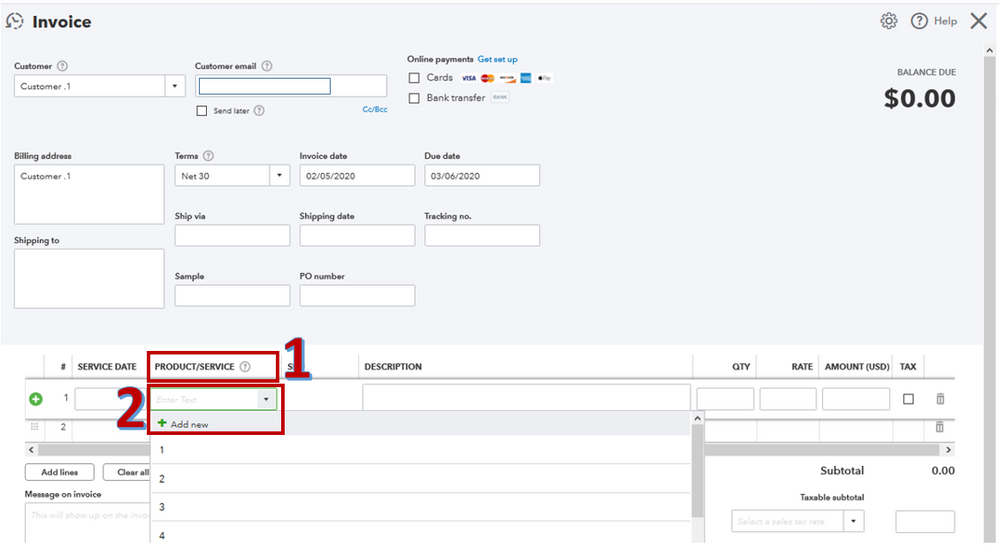

Recording Credit Card Transactions In Quickbooks Best Practices

Guide To Quickbooks Credit Card Processing And Data Integration

Pay Down Credit Card In Quickbooks Online Quickbooks Credit Cards

How Can I Record A Credit Card Fee When The Customer Paid In Full But We Were Charged A Fee By Merchant Services So The Fee Will Be Included In The Costs

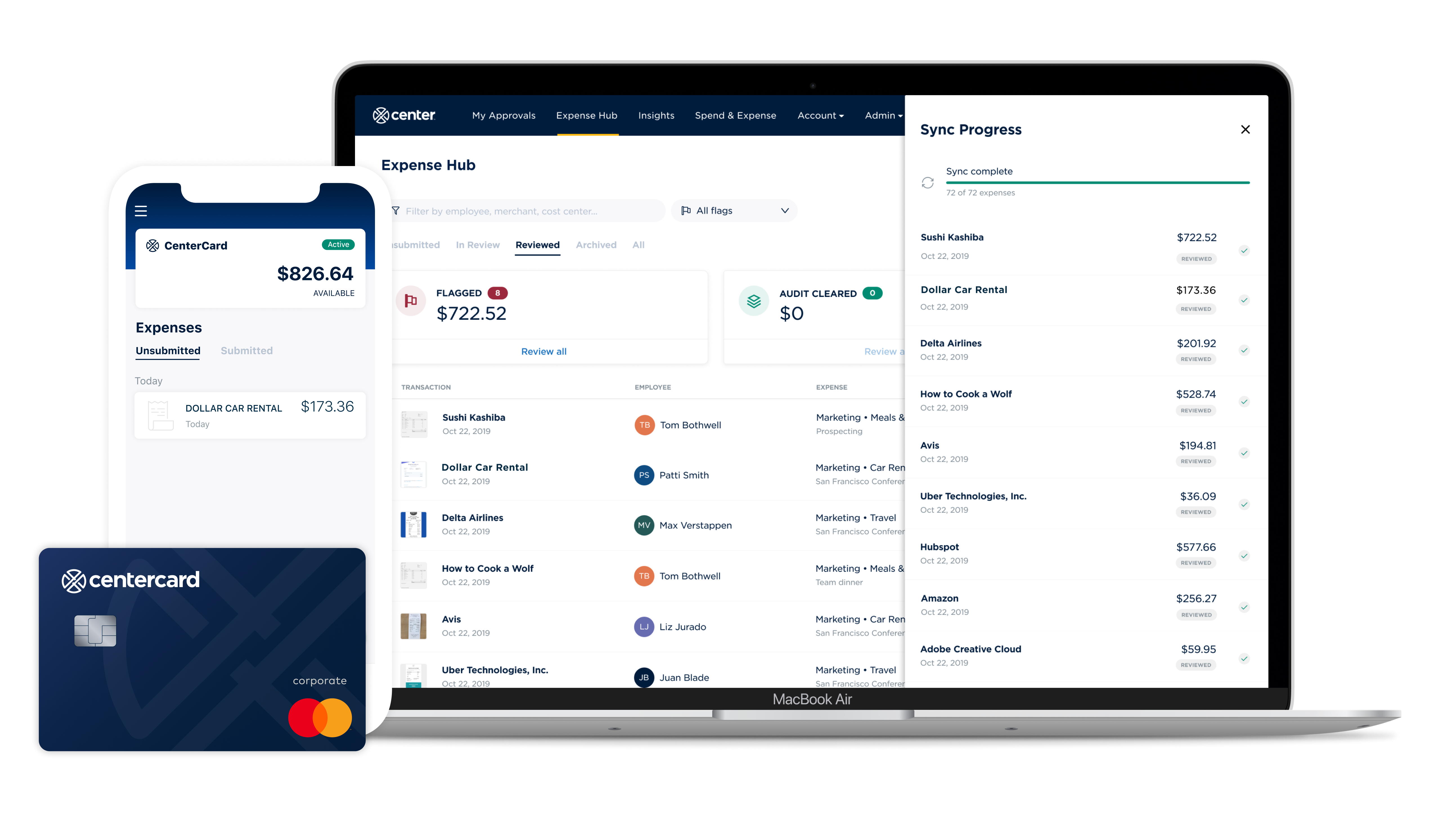

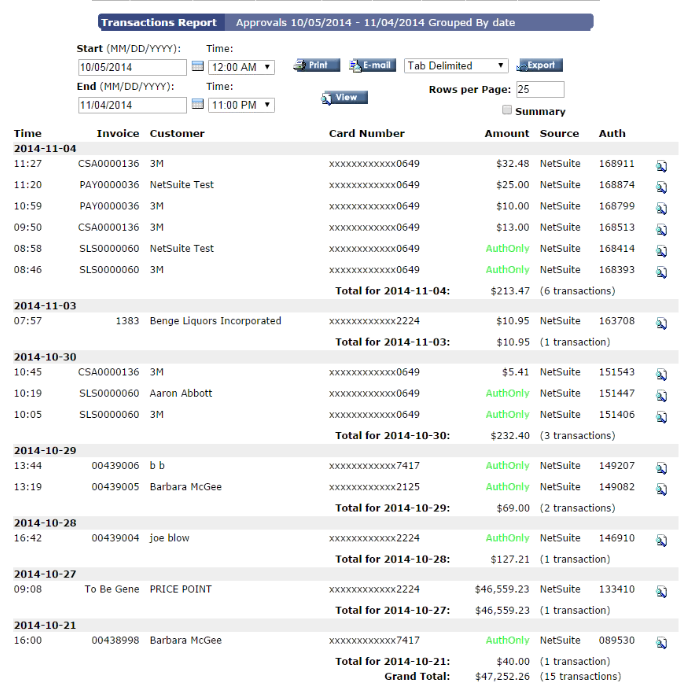

Center Introduces Credit Quickbooks Integration Center

Quickbooks Payments Review 2022 Intuit Merchant Services

Solved How Do I Record A Credit Card Credit Given To Me By The Bank To Refund A Fraudulent Purchase

Solved How Do I Record A Credit Card Credit Given To Me By The Bank To Refund A Fraudulent Purchase

Quickbooks Gopayment Review Card Reader App Fees

Solved Our Company Does Not Accept Credit Cards As Payment How Can I Prevent This In Qbo

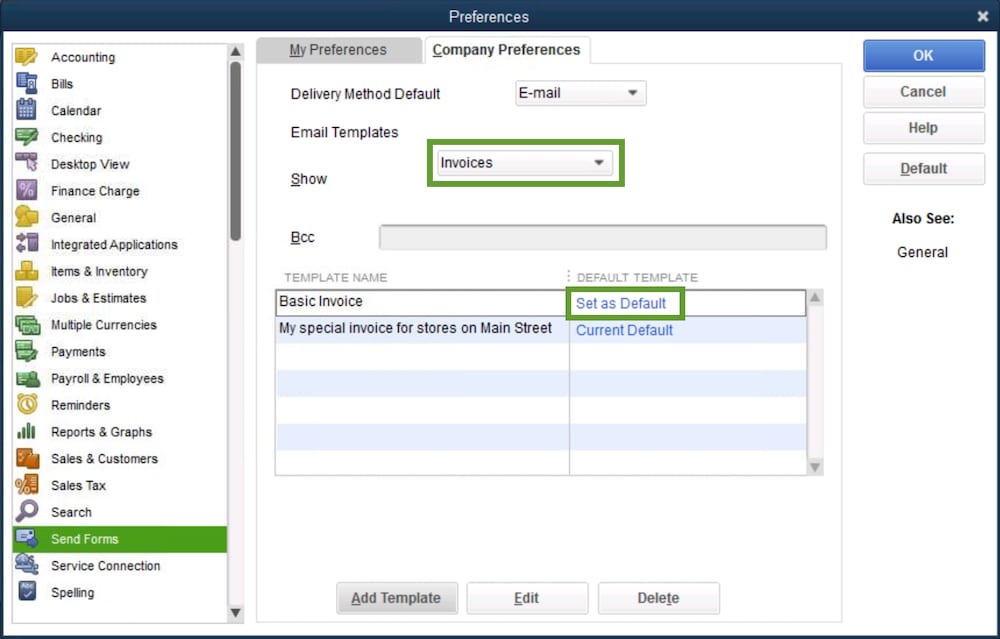

Credit Card Processing In Quickbooks Desktop Pro Century Business Solutions

Credit Card Transactions In Quickbooks 2021 Dummies

Recording Credit Card Transactions In Quickbooks Best Practices

Guide To Quickbooks Credit Card Processing And Data Integration

How To Add A Payment Link To Quickbooks Invoices Lawpay

Credit Card Processing In Quickbooks Desktop Pro Century Business Solutions